Most of my public posts to date have centred around climate finance and the energy transition. But few also know, I have been an avid investor for ~15 years. Like many, my journey began with value investing. The Intelligent Investor, Little Book of Common Sense, One Up on Wall Street, A Random Walk Down Wall Street, shaped how I evaluated companies, made allocation decisions, and ultimately managed my own portfolio. In 2016, I was introduced to the digital asset market, an abrupt (and insightful) departure from what I had analysed so far. Needless to say the volatility was insane for someone who had been hesitant to even touch small-cap equities.

“Strong opinions, loosely held.”

But in late 2023, I came across a Marc Andreessen podcast I had first listened to in 2018. “Strong opinions, loosely held.” That phrase impacted my entire world – business, investments, relationships.The ability to develop strong conviction and remain open to feedback, to admit you are wrong. Humility is an uncommon trait, anywhere. I could not remember the last time I had critically evaluated my decision-making. So I took my thought process back to first principles, 1) what outcome was I trying to optimise for, and 2) was my current was approach building towards this outcome.

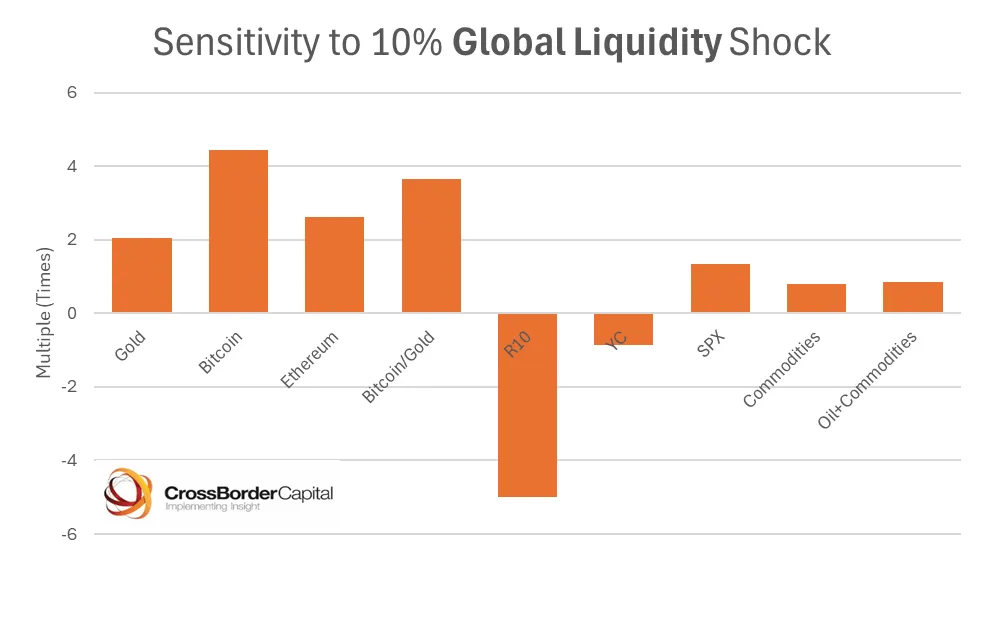

Enter the liquidity thesis. Whilst no stranger to economic data – I have been in financial services (debt and equity) for over a decade – I had never seriously considered the impact of liquidity on risk asset valuations. What changed? A friend introduced me to the work by Michael Howell and encouraged me to revisit my apprehension to digital assets. Eventually, I did. The below is some of what I’ve put together in the hope it will challenge, inform and encourage a broader view of capital markets.

Liquidity Fundamentals

Consider that since 2020 money supply growth has accelerated to ~9% per year (debasement1). Since 1985, the USD has been printed at an average rate of 6.5% per year. If we then fold in inflation2 at let’s say ~3% per year, we reach an annual hurdle rate of ~12% per year to keep up with debasement and inflation.

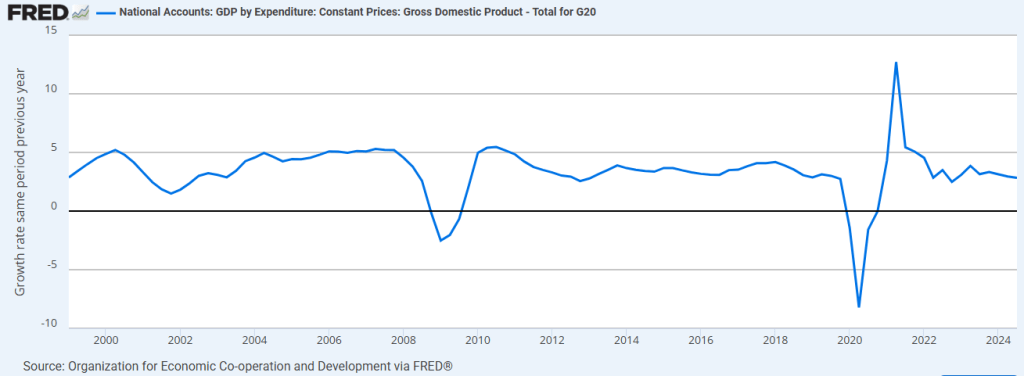

From a macro standpoint we now need to look at GDP growth. Why? Because GDP is the cashflow that pays for the debt. The debt is what has been accumulated at the private and public sector levels.

GDP Growth = Population Growth + Productivity Growth + Debt Growth

We clearly need GDP growth to increase but we clearly see the trend rate of growth has been on a steady decline. In the USA its ~1.75%, Australia ~3.30%, Europe 1.60%, and the G20 ~3%. But what the below graph does not show is the rate of growth has been on a steady decline for some time, in the developed world.

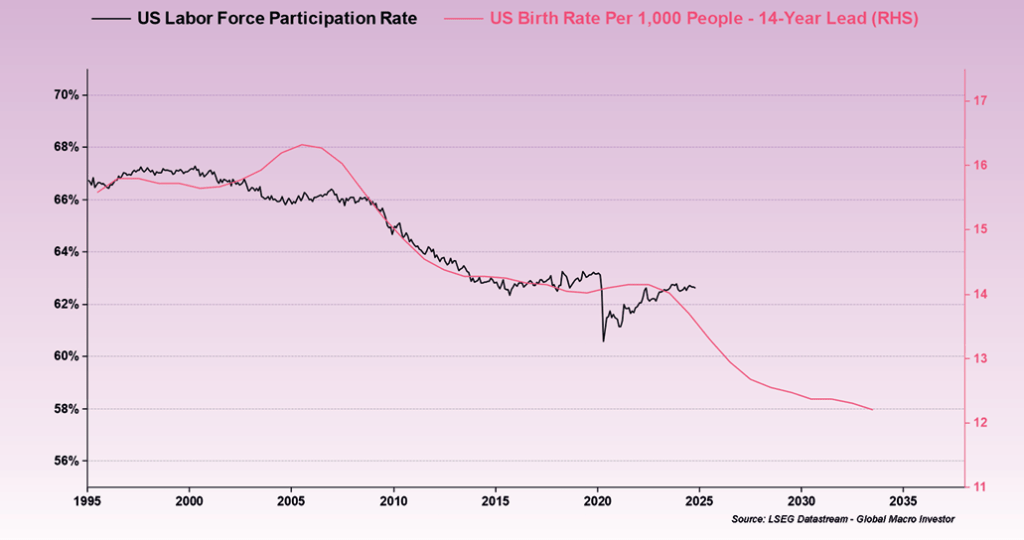

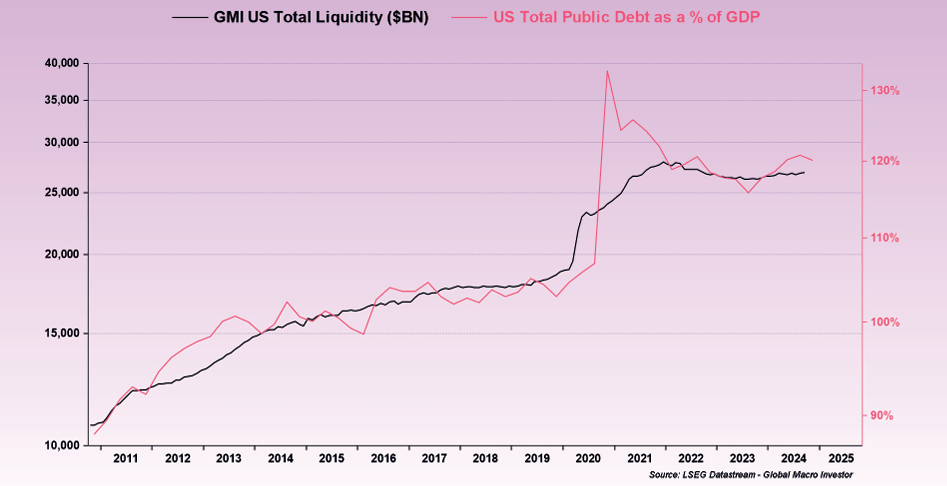

Why has the rate of growth been in decline? If we look at the above equation we know population is not only declining, but aging rapidly – labour force participation in the USA has fallen ~3% over the last 30 years (63% in 2024, forecast to be 58% in 2035). We know productivity (units of output per kilijoule of energy) has stalled. And so, to offset that, debt as a % of GDP (particularly government debt post 2008) has boomed. How do you manage ballooning interest payments, liquidity.

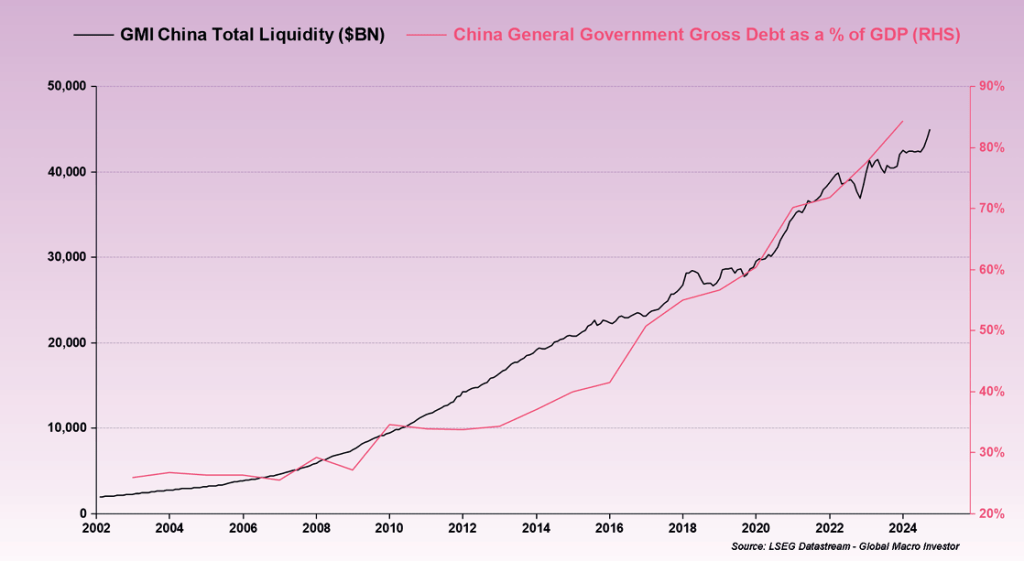

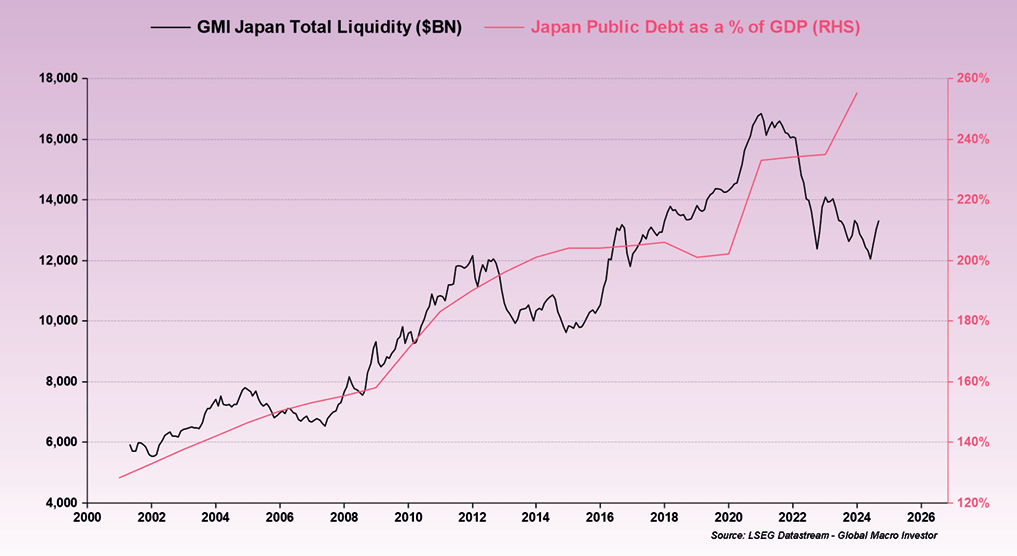

There is a reason why global liquidity has increased US$10.3 trillion since 2022. For me, 3 markets are key to watch – the US, China, and Japan. Each will need to print outrageous amounts to address structural issues within their respective economies. As they do that, we will see debasement accelerate.

The Mighty US Dollar

An increased velocity of money supply (liquidity printing) will generally cause currency devaluation, could make exports more expensive, and by extension create inflationary pressures across the economy.

A challenge for China and Japan has been the strength of the US dollar (“USD”). For both economies, the strong USD has meant the capacity to print Chinese Yuan (“CNY”) or Japanese Yen (“JPY”) is constrained given its impact on trade, inflation, and ongoing debt obligations. Put succinctly, China and Japan both need a weaker USD to allow for more money printing that would still maintain relative competitiveness with the USD.

The most likely course of action is that the draining of the Treasury General Account will trigger the USD to fall. That will calm US bond yields, improve debt serviceability, and deepen refinancing capacity. A softer USD means the PBOC and Bank of Japan have room to then print to meet their increasing debt levels and in the case of China to also stimulate growth.

That is an overly simplistic way of writing about a highly complex world. But the overarching message is not to focus on the minutiae of global markets, but the why. If we can understand how the system is designed, its implications, we can develop probabilistic outcomes.

Strong opinions loosely held.

- Debasement is the declining value of a currency. Historically, this occurred through decreasing precious metal content in a currency (i.e. when fiat was asset-backed). In modern terms, this refers to the increase in money supply without any wealth increase leading to purchasing power dilution. ↩︎

- The general increase in the price level of goods and services in an economy over time. Debasement can influence inflation, but is generally influenced by “demand-pull” (increased demand) and “cost-push” (higher production costs) factors. ↩︎

Leave a comment