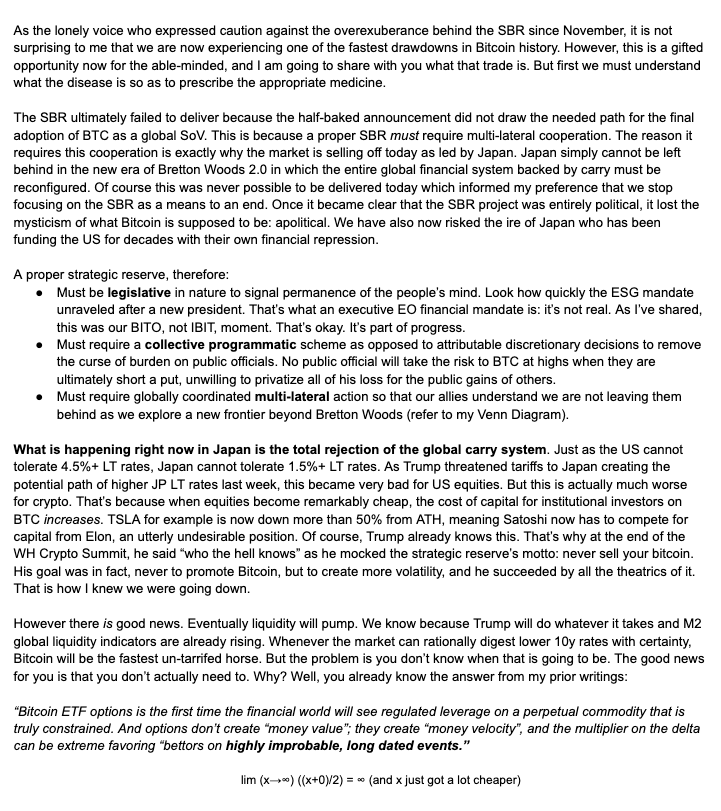

“The EO strategic reserve is singularly the most attributable, political, public facing entity that no sensible politician will risk their career on a move that could backfire spectacularly when it comes to actual action, not just words. Just take a minute and think about it, and recognize that this is just pure political survival instinct. Actions have accountability in ways words do not. That’s why the only way to have a credible reserve program that could ever drive forward impact is one in which there are 1) shared decision making therefore shared culpability, 2) programmatic buying vs discretionary “studies of budget neutral things” and 3) a sense of legislative permanence so that other foreign actors can take it seriously OR just do it in private authoritatively (like how the Middle East and China).” – March 10, 2025, Jeff Park, Bitwise

Amidst the exuberance, inflated expectations, and misinformation, Jeff Park stands out for his rational, common sense approach, rooted in principled decision making.

Many in the cryptocurrency space have imagined a market that was flushed with capital from Institutional investors. The influx of capital would bring about a severely imbalanced BTC market where demand far outstripped supply. From there we would see price discovery well and truly beyond the $100k threshold. One can dream. My conviction we see this in the next 12 months remains unshaken. But to think a fundamental shift to US policy, not seen since the 1970s when Nixon ended dollar convertibility to gold, would happen within the first 2 months of a new Administration – even if it is Trump – was wishful thinking. The Strategic Bitcoin Reserve (“SBR”) might happen, it might not.

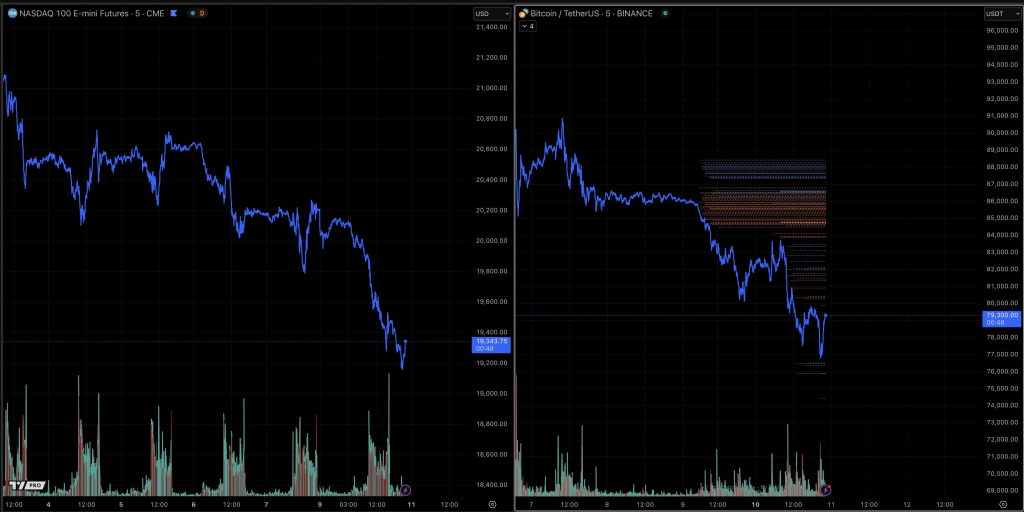

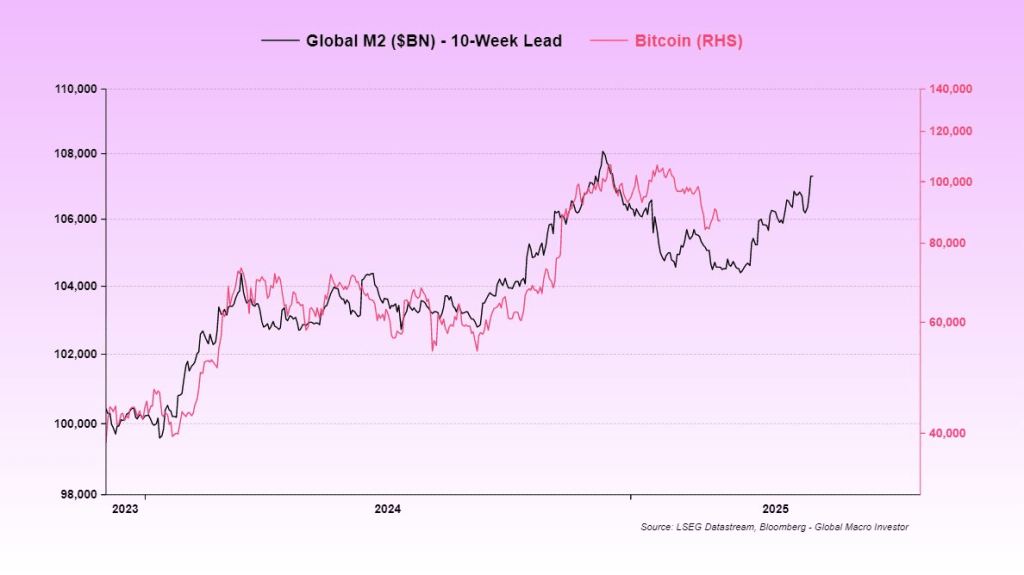

At this juncture, as with any period of consolidation/drawdown, we need to zoom out. Equity markets are weak, driven by macro uncertainty. Bitcoin, a risk asset, has been caught up in that storm. What is calming to me though is to remind myself, volatility is your friend. 30% drawdowns are normal, and allow for relative outperformance over time.

Financial conditions remain tight, the USD remains strong. Eventually things will play out but patience and discipline are key.

Thought Experiment: Put or Call?

One last point swirling in my mind. What if the SBR is more of a put then a call. A drawdown would allow for accumulation at 60-70k, whilst the SBR provides potential demand to sell at a future date.

“Can you imagine the headlines that will come for trump if he buys bitcoin at 100k and it goes to 70k? on the positive side, if BTC gets to very cheap levels, the incentives for politicians and sovereigns to buy will increase as the probabilistic outcome of their decisions permit the chance for them to make the “hero trade” and get the public reward of messianic recognition. it is always +EV for the incentive calculation of an executive branch (which must win elections) to wait for BTC to get to 60k and buy and take credit. at the core thats why the SR is ultimately a put, not a call.”

Rather than a focus on the SBR, a focus on lower 10y rates is perhaps the more pertinent factor here. Ignore the noise.

“When you learn the trading skill of risk acceptance, the market will not be able to generate information that you define or interpret as painful. If the information the market generates doesn’t have the potential to cause you emotional pain, there’s nothing to avoid. It is just information, telling you what the possibilities are. This is called an objective perspective—one that is not skewed or distorted by what you are afraid is going to happen or not happen.” – Mark Douglas, Trading in the Zone

Jeff Park on the Strategic Bitcoin Reserve

Leave a comment